Our experience and track record in allocating both philanthropic capital and commercial capital has highlighted a number of challenges faced by both not for profits as well as social enterprises in achieving scale and sustainability.

Valley of Death

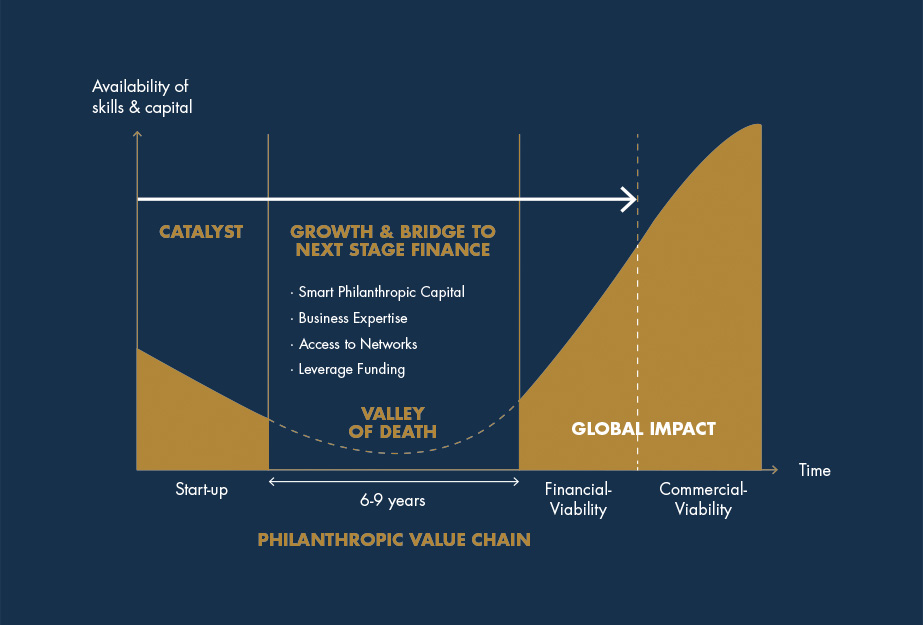

One common challenge is often referred to as the valley of death, or pioneer gap. As organisations grow, they exhaust the supply of grant funding – which seeks to achieve impact but no return of capital. But these organisations neither have the track record nor financial returns to attract impact investment (which seeks both impact and a return on capital invested). Without patient capital ( that seeks a return of capital) and skills support, these organisations will never achieve their potential scale of impact.

Philanthropists and foundations are ideally positioned to solve the valley of death through incorporating return of capital financial instruments alongside grants. These are typically referred to as Program Related Investments or Social Investments, with the prime purpose still being to achieve impact. Such instruments can include repayable grants, convertible grants, patient loans and guarantees. By utilising return of capital instruments, philanthropists can:

- Help organisations scale-up, increase impact and become financially viable

- Leverage other forms of investment and thus compound impact

- Allow financial returns to recycled to further philanthropic goals